Ok, it's been a while since I started thinking of buying a different ETF. At the moment I have a good spread of the Satrix Indi and eRafi Indi. Both of those are heavily weighted in one share, the STX in Naspers and the eRafi in MTN.

Then on another note, I'm kind of in the home stretch to quitting my job, with somewhere between 1 and 5 years to go (obviously depends on many things), and that makes me think a little about dividends. While I know that selling shares is favourable income tax wise if you're a low earner, I do quite like seeing money magically appear in my account as it does with dividends.

So since I'm not clever enough to pick a share, I thought I'd look around and see what ETFs there are that pay reasonable dividends, and hopefully also provide some growth. Ideally they would also not have > 15% in a single share like STXIND and RAFIND do.

So I looked at the Satrix Divi, but it's performance has been pretty terrible over the last while. Growth (including dividends) over 1 year of 5.6%, over 2 years was 8% and over 5 years 12.6%. Not somewhere I want to put any money.

Fortunately last year Grindrod introduced the Dividends Aristocrats ETF. It's based on the S&P SA Dividend Aristocrats index. It's calculated on an equal weighting of companies that have either maintained, or increased their dividends for 5 years running. If you want all the details on how they got there, you can read here:

http://www.moneyweb.co.za/archive/not-all-dividend-funds-are-made-equal/The performance has been great. 29% in 1 year, 23.7% in 3 years and 22.3% in 5 years, including the yield of about 3%.

Here are the shares that make up the index. Initially they were all equally weighted:

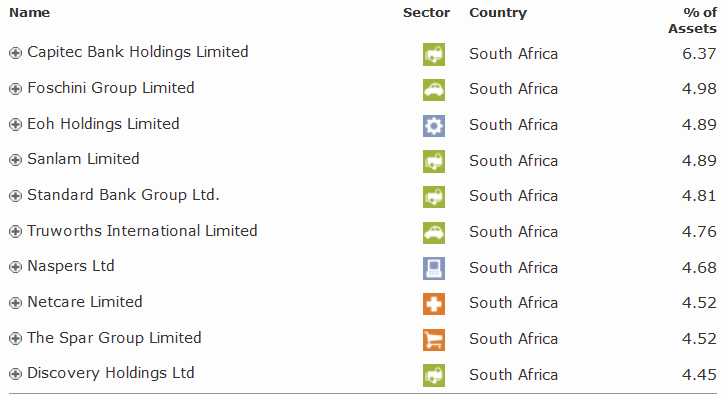

But as they are only rebalanced once a year (July), the ratios change as shares increase or decrease in value, so the top 10 right now are:

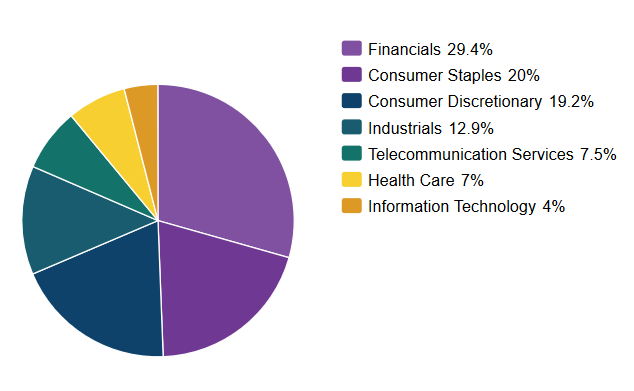

And the current sector allocation:

And lastly, how the share has compared to the Satrix Indi (Indi in black), remember that you would need to add another 1.6% to the DIVTRX as it had a yield of +- 3% over the indi's +-1.4%:

It's not often I do a comparison chart and see an ETF hovering about the Indi. Any other opinions on this ETF?