61

This section allows you to view all posts made by this member. Note that you can only see posts made in areas you currently have access to.

62

Shares / Taste rights issue

« on: November 16, 2015, 10:38:06 am »

Anyone know anything about this. I can't seem to find the sens.

63

Shares / Interesting presentation from ABSA stockbrokers last night

« on: November 05, 2015, 08:24:23 am »

I went to one of their seminars. This one was called "Build better portfolios using ETFs", so it was right up my alley.

Points of interest:

Points of interest:

- I asked how they were able to keep their ETF fees so low, everyone else is +-0.4%, DBX is nearly 1%, but the ABSA ETFs are +-0.13%. Their answer - "We provide them at cost to encourage investing". Whether or not that's true is debatable, but they are three times cheaper than anyone else.

- ABSA has launched a new ETF only account. Just like their TFSA it works on 0.2% commission, the best in SA, there are no monthly fees, but it has a R20 minimum, so ideally you would only use it if you trade R10 000 a month or more. The break even point comes in at R8000 a month. Invest more than that in ETFs and you want to be with ABSA, less than that then easy equities wins.

- The TFSA has no minimum because the JSE offers a discount on their fees for TFSAs.

- Afterwards I asked one of the ABSA ETF staff when they were going to launch a competitor to the DBX trackers. I said it they could do that, at reasonable fees they'd have people throwing money at them. Apparently it's on the cards. During the discussion he also mentioned that ABSA wants to put themselves into the market as a kind of a local Vanguard. Yes surprisingly they know of Vanguard, and know that the low profit high volume model works for them.

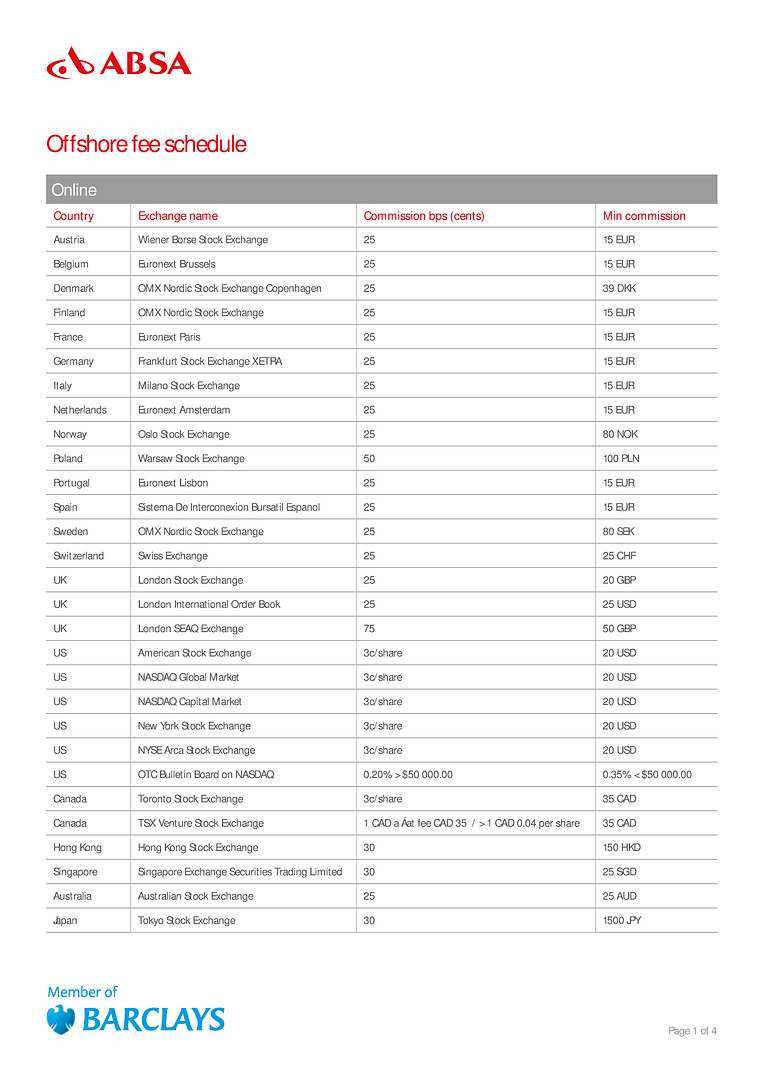

- And the big topic of the night. If they are to be believed, ABSA will be launching international trading on 28 global markets by the end of November. There will be no additional monthly fees, and trading fees will be based on the destination market. You will first have to convert your Rand into Dollars or Euros, and ensure you don't go over your R1m allowance, then transfer into their foreign currency account, but after that you can buy pretty much whatever you want globally. I'm going to keep an eye out for that one.

64

The Investor Challenge / Blog post: The cost of NOT providing free education

« on: November 02, 2015, 04:48:36 pm »65

Off topic / When do workers stop getting increases

« on: October 21, 2015, 09:02:16 am »

I thought this was an interesting read. It seems to suggest that you are at your earnings peak at around 35. It does apply in my case too, as we have very structured pay levels where I work, and now that I'm on the top level, all I'll get are inflation increases. Fortunately as my investments grow, they give me another increase

http://www.theatlantic.com/business/archive/2015/10/at-what-age-do-workers-stop-getting-raises/409153/

http://www.theatlantic.com/business/archive/2015/10/at-what-age-do-workers-stop-getting-raises/409153/

66

The Investor Challenge / Blog post: It's all about the timing... Or is it?

« on: October 04, 2015, 01:10:01 pm »67

The Investor Challenge / Blog post: Can you de-complicate personal finance?

« on: September 01, 2015, 11:43:23 am »68

The Investor Challenge / Lost some purchase records

« on: August 21, 2015, 03:01:28 pm »

Hi all,

For some weird reason, the entire purchasing table was wiped out today. This is quite weird, as nowhere in my code is there ever a delete statement referencing that table, so I can only assume it was a bug. I've managed to run a backup from two days ago, but I have lost 69 purchase records. I'll be spending some time thinking of how to get these back.

Potentially I could compare the purchase list with the current holding list and find any anomalies as the current holding table was not affected. Then I'd have to see if the current net worth doesn't add up and reconcile that to get the price.

Bear with me, it's not going to be easy or fun!

For some weird reason, the entire purchasing table was wiped out today. This is quite weird, as nowhere in my code is there ever a delete statement referencing that table, so I can only assume it was a bug. I've managed to run a backup from two days ago, but I have lost 69 purchase records. I'll be spending some time thinking of how to get these back.

Potentially I could compare the purchase list with the current holding list and find any anomalies as the current holding table was not affected. Then I'd have to see if the current net worth doesn't add up and reconcile that to get the price.

Bear with me, it's not going to be easy or fun!

70

Shares / Stockpicking or ETFs

« on: July 27, 2015, 12:44:06 pm »

So, I quite like this debate as my brother in law is an analyst for a fund management firm. I've written about why I think they're a waste of cash before (http://investorchallenge.co.za/those-fees-are-blatantly-robbing-you/), but now the head of sygnia has jumped in with a great article, also in favour of passive investing: http://www.moneyweb.co.za/investing/unit-trusts/arguments-against-passive-investing/

Is there anyone here who still considers units trusts a decent investment?

Maybe a different question, but how many people here think they can beat the index over a decent period of time?

Is there anyone here who still considers units trusts a decent investment?

Maybe a different question, but how many people here think they can beat the index over a decent period of time?

71

Off topic / What I worked on this weekend...

« on: July 14, 2015, 12:11:57 pm »

It's quiet here at the moment, so I thought I'd show you what I worked on this weekend. For once it's not an app or a bicycle

As you know I'm all about stealth wealth, so now that the time has come to get a set of wedding bands, I decided to go the DIY route. I've always liked the look and feel of wood, and after some googling I saw that it could be possible to make rings out of it. Headed to timber city, and spent about R200 on wood, sandpaper and glue, then proceeded to glue my fingers together over an evening, but here's the outcome:

Turns out I bought too much wood. I got 5 meters, but only used 1 meter making 3 mistakes and two great rings.

Step one is boiling, step two is rolling and glueing. That's actually the hard part, making sure you don't splinter the wood or glue your fingers together. I did both. Repeatedly. The next step involves sanding. Steps 4 through 258 are also sanding!

Here's the end result. I like it, my fiance likes it, and it's very tough. As much as I tried I couldn't break one of the mistakes.

The smaller ring was far harder to make, but the fiance loves it

As you know I'm all about stealth wealth, so now that the time has come to get a set of wedding bands, I decided to go the DIY route. I've always liked the look and feel of wood, and after some googling I saw that it could be possible to make rings out of it. Headed to timber city, and spent about R200 on wood, sandpaper and glue, then proceeded to glue my fingers together over an evening, but here's the outcome:

Turns out I bought too much wood. I got 5 meters, but only used 1 meter making 3 mistakes and two great rings.

Step one is boiling, step two is rolling and glueing. That's actually the hard part, making sure you don't splinter the wood or glue your fingers together. I did both. Repeatedly. The next step involves sanding. Steps 4 through 258 are also sanding!

Here's the end result. I like it, my fiance likes it, and it's very tough. As much as I tried I couldn't break one of the mistakes.

The smaller ring was far harder to make, but the fiance loves it

72

The Investor Challenge / Blog post: The Compounding Story of the Doctor and the Model

« on: June 30, 2015, 07:45:13 am »73

Shares / CoreShares Dividend Aristocrats ETF/S&P SA Dividends Aristocrat

« on: June 25, 2015, 11:37:02 am »

Ok, it's been a while since I started thinking of buying a different ETF. At the moment I have a good spread of the Satrix Indi and eRafi Indi. Both of those are heavily weighted in one share, the STX in Naspers and the eRafi in MTN.

Then on another note, I'm kind of in the home stretch to quitting my job, with somewhere between 1 and 5 years to go (obviously depends on many things), and that makes me think a little about dividends. While I know that selling shares is favourable income tax wise if you're a low earner, I do quite like seeing money magically appear in my account as it does with dividends.

So since I'm not clever enough to pick a share, I thought I'd look around and see what ETFs there are that pay reasonable dividends, and hopefully also provide some growth. Ideally they would also not have > 15% in a single share like STXIND and RAFIND do.

So I looked at the Satrix Divi, but it's performance has been pretty terrible over the last while. Growth (including dividends) over 1 year of 5.6%, over 2 years was 8% and over 5 years 12.6%. Not somewhere I want to put any money.

Fortunately last year Grindrod introduced the Dividends Aristocrats ETF. It's based on the S&P SA Dividend Aristocrats index. It's calculated on an equal weighting of companies that have either maintained, or increased their dividends for 5 years running. If you want all the details on how they got there, you can read here: http://www.moneyweb.co.za/archive/not-all-dividend-funds-are-made-equal/

The performance has been great. 29% in 1 year, 23.7% in 3 years and 22.3% in 5 years, including the yield of about 3%.

Here are the shares that make up the index. Initially they were all equally weighted:

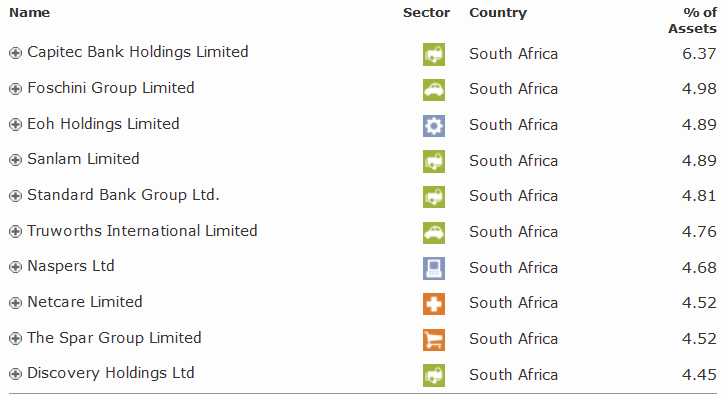

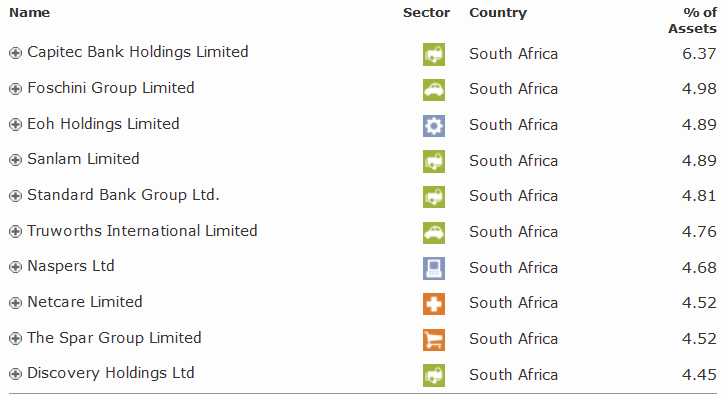

But as they are only rebalanced once a year (July), the ratios change as shares increase or decrease in value, so the top 10 right now are:

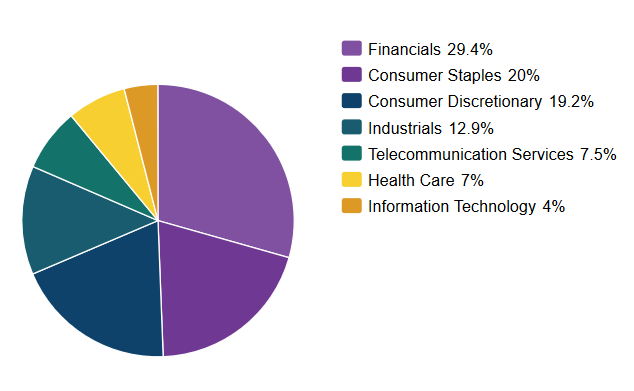

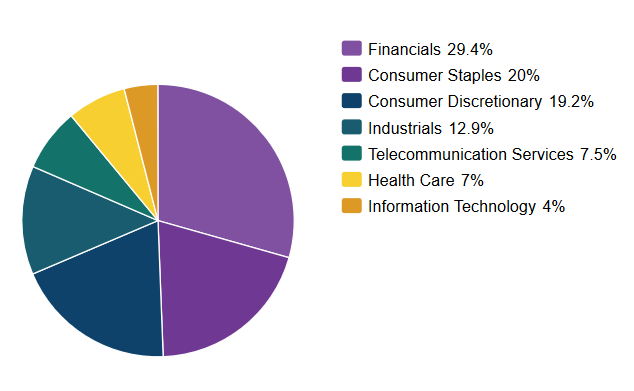

And the current sector allocation:

And lastly, how the share has compared to the Satrix Indi (Indi in black), remember that you would need to add another 1.6% to the DIVTRX as it had a yield of +- 3% over the indi's +-1.4%:

It's not often I do a comparison chart and see an ETF hovering about the Indi. Any other opinions on this ETF?

Then on another note, I'm kind of in the home stretch to quitting my job, with somewhere between 1 and 5 years to go (obviously depends on many things), and that makes me think a little about dividends. While I know that selling shares is favourable income tax wise if you're a low earner, I do quite like seeing money magically appear in my account as it does with dividends.

So since I'm not clever enough to pick a share, I thought I'd look around and see what ETFs there are that pay reasonable dividends, and hopefully also provide some growth. Ideally they would also not have > 15% in a single share like STXIND and RAFIND do.

So I looked at the Satrix Divi, but it's performance has been pretty terrible over the last while. Growth (including dividends) over 1 year of 5.6%, over 2 years was 8% and over 5 years 12.6%. Not somewhere I want to put any money.

Fortunately last year Grindrod introduced the Dividends Aristocrats ETF. It's based on the S&P SA Dividend Aristocrats index. It's calculated on an equal weighting of companies that have either maintained, or increased their dividends for 5 years running. If you want all the details on how they got there, you can read here: http://www.moneyweb.co.za/archive/not-all-dividend-funds-are-made-equal/

The performance has been great. 29% in 1 year, 23.7% in 3 years and 22.3% in 5 years, including the yield of about 3%.

Here are the shares that make up the index. Initially they were all equally weighted:

But as they are only rebalanced once a year (July), the ratios change as shares increase or decrease in value, so the top 10 right now are:

And the current sector allocation:

And lastly, how the share has compared to the Satrix Indi (Indi in black), remember that you would need to add another 1.6% to the DIVTRX as it had a yield of +- 3% over the indi's +-1.4%:

It's not often I do a comparison chart and see an ETF hovering about the Indi. Any other opinions on this ETF?

74

Off topic / Standard Chartered's view of SA

« on: June 18, 2015, 03:04:13 pm »

I'm busy sitting through a presentation from the Standard Chartered South Africa CEO. He's going through the whole of Southern Africa, but I thought I'd post this slide on how he sees South Africa going. The basic view is three tough years, then improvement.

75

Off topic / Andrew Donaldson: Asking RW Johnson why SA only has two years left

« on: June 04, 2015, 12:01:57 pm »

I thought this was a pretty good read, any thoughts?

http://www.biznews.com/thought-leaders/2015/06/01/andrew-donaldson-asking-rw-johnson-why-sa-only-has-two-years-left/

http://www.biznews.com/thought-leaders/2015/06/01/andrew-donaldson-asking-rw-johnson-why-sa-only-has-two-years-left/